Get all basic needs with zero balance saving accounts bsbda basic savings bank deposit account pmjdy pradhan mantri jan dhan yojana.

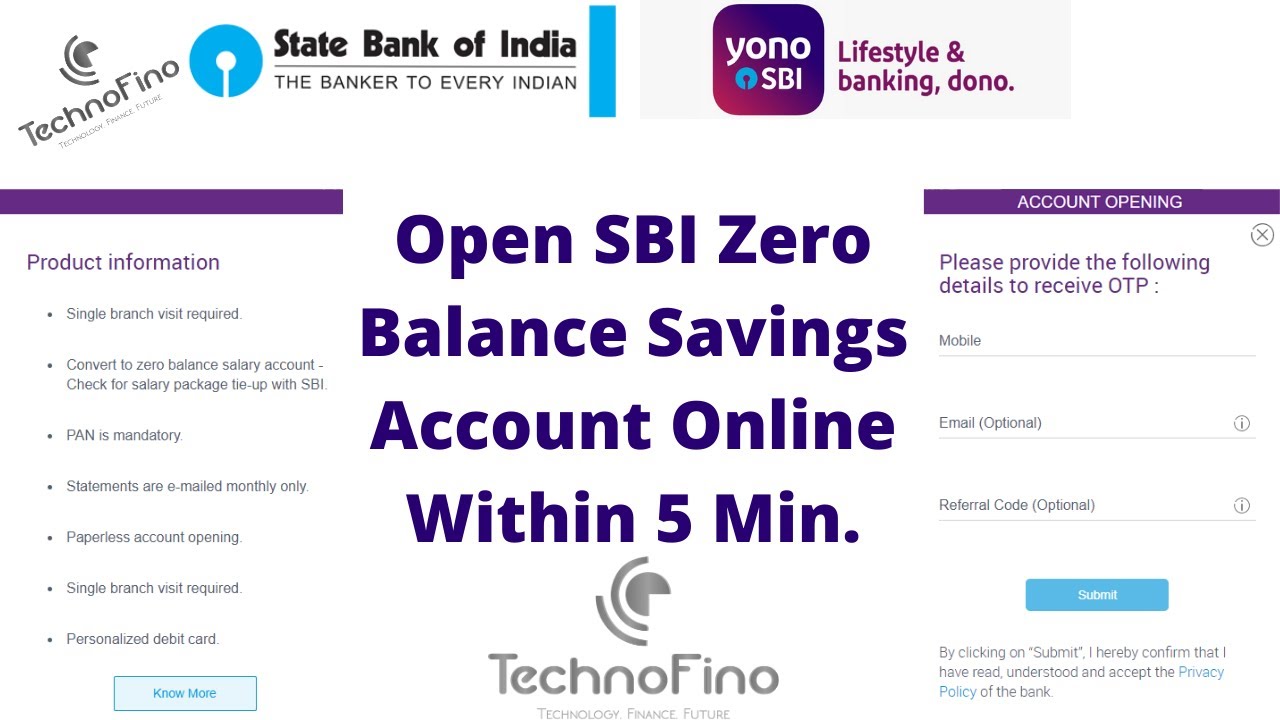

Zero balance sbi jan dhan account opening online.

Most important terms conditions.

If the customer already has a savings bank account the same will have to be closed within 30 days of opening a basic savings bank deposit account.

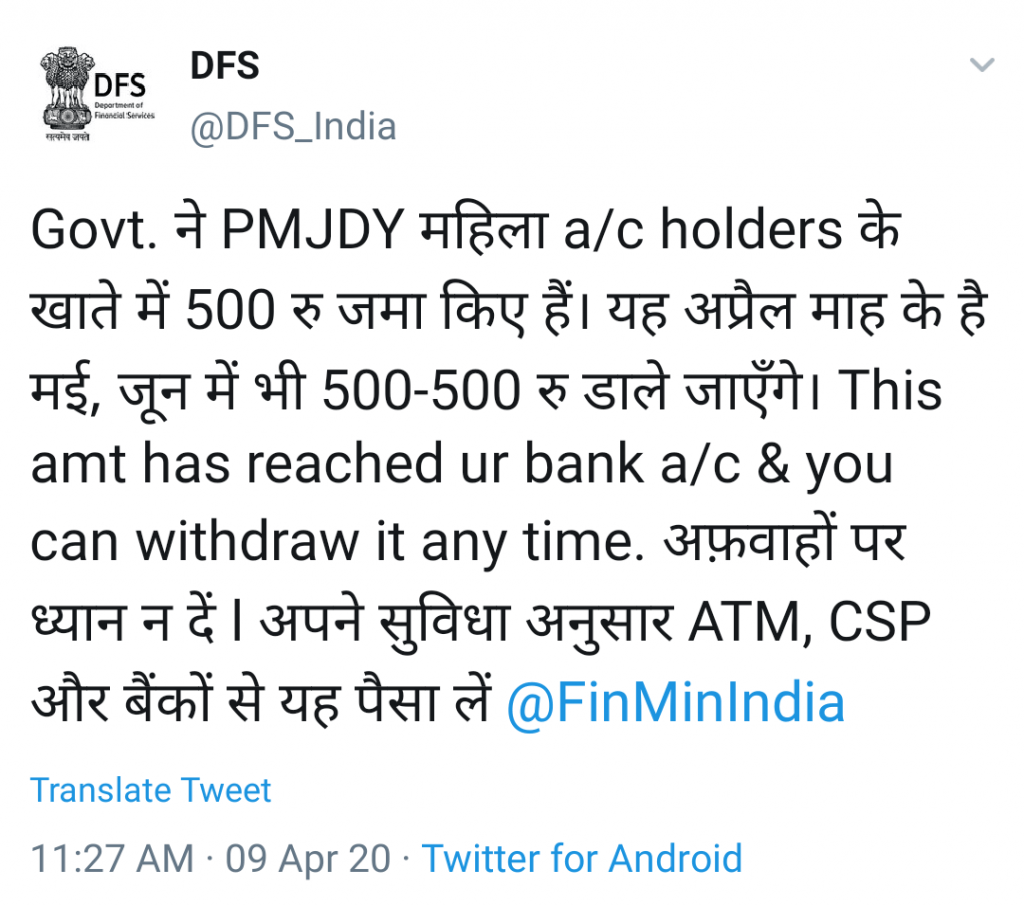

As part of the pradhan mantri garib kalyan yojana that was announced by the government of india as part of the covid 19 economic stimulus more than 20 crore account holders of the pradhan mantri jan dhan yojana who are women will receive rs 500 per month for the next three months.

Every person with a jan dhan yojna account will receive a life insurance cover of rs.

News about zero balance account through pm jan dhan yojana.

The customer cannot have any other savings bank account if he she has a basic savings bank deposit account.

Pradhan mantri jan dhan yojana pmjdy is a national mission on financial inclusion.

A person needs to be a citizen of india age should be 10 years and above.

Jan dhan yojana eligibility.

Sbi form for opening account in pm jan dhan yojana in english.

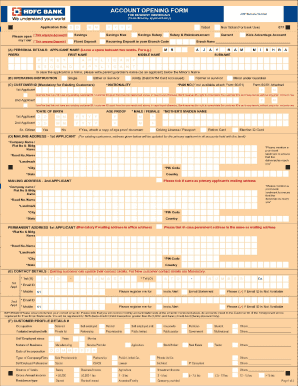

For documentation and details visit icici bank.

Account can be opened in any bank branch or business correspondent bank mitr outlet.

To open a basic savings bank deposit account bsbda with zero balance under pradhan mantri jan dhan yojana a person needs to fulfil the below criteria.

Since the account will be zero balance so there is no minimum balance required to keep your account running.

Documents required to open an account under pradhan mantri jan dhan yojana.

Update from india govt about covid 19.

To open a basic savings bank deposit account bsbda with zero balance under pmjdy you need to fulfill the below conditions.

1 lac adding value to lives.

Pmjdy accounts are being opened with zero balance.

If address has changed then a self certification.

If aadhaar card aadhaar number is available then no other documents is required.

The plan envisages universal access to banking facilities with at least one basic banking account for every adult financial literacy access to credit insurance and pension facility.

30 000 and accidental cover of rs.

10 years and above do not have bank account additional read.